At FundRight, we're pioneering the integration of advanced data science techniques to revolutionize the matchmaking process between startups and investors. Our QuickMatch feature is not just another algorithmic tool; it's a testament to how precision analytics can enhance the investment landscape. Central to our approach is the use of regression analysis, correlation studies, and the power of PyTorch for Machine Learning (ML) operations, ensuring that our predictions are not only accurate but also meaningful.

Harnessing Regression Analysis for Predictive Insights

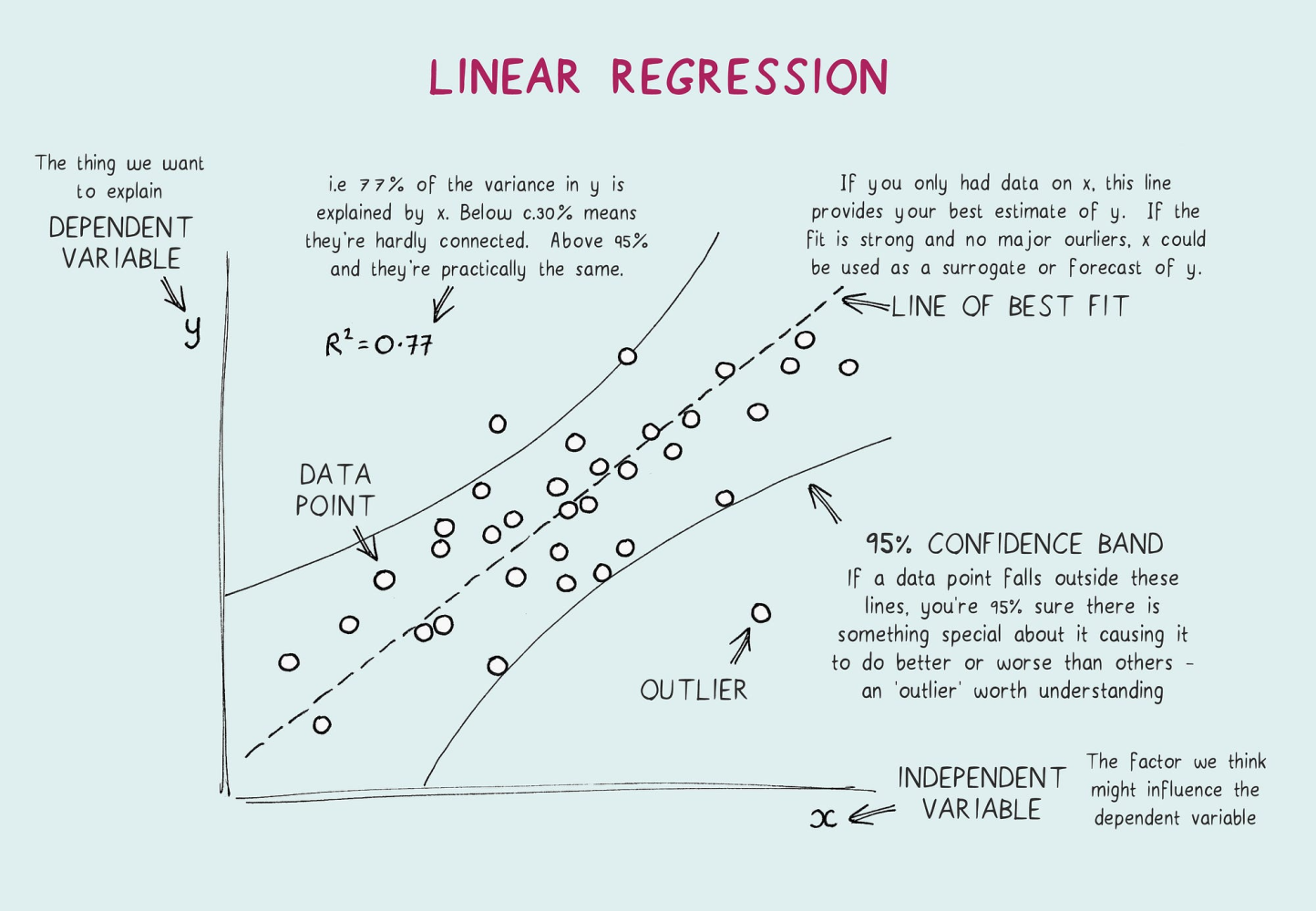

Regression analysis stands at the forefront of our predictive capabilities. This statistical method enables us to identify relationships between independent variables (like startup metrics) and a dependent variable (the likelihood of becoming a unicorn). By analyzing historical data of successful startups, we can create a model that predicts a new startup's success potential based on specific input metrics. This approach allows investors to gauge the potential return on investment (ROI) with a higher degree of precision, making investment decisions more data-driven and less speculative.

Regression analysis doesn't just map the path of startups; it delves into the narrative of their growth, turning numbers into a story of potential and probability. Imagine every startup's journey as a series of waypoints, a unique combination of factors like user engagement, market size, and even the experience of its founding team. These aren't just isolated data points but chapters of a bigger saga that regression analysis helps to unfold.

The beauty of this statistical method lies in its ability to cut through the noise and find the harmony in the data, distinguishing coincidence from causality. When we talk about startup metrics, we're really talking about a language that describes how ideas ignite and gain momentum, how they carve out a niche in the market, or how they adapt and survive.

Our model is like an alchemist's crucible, turning the lead of raw data into the gold of actionable insights. With each historical success story, we refine our understanding, sharpening our predictions for the new ventures on the horizon. It’s here that the investors find their compass—a way to navigate the tumultuous seas of venture capital with a map charted by the constellations of past entrepreneurial triumphs.

Investment, in this context, becomes less of a gamble and more of an informed strategy. It's like reading the weather patterns before setting sail. By predicting the success potential of new startups, investors can set their course with a confidence born from a blend of experience and evidence, not just instinct or trend-chasing.

So when we speak of a startup's 'likelihood of becoming a unicorn', we're not casting a whimsical spell but making a forecast based on a careful study of the entrepreneurial ecosystem. This analysis turns the intangible—dreams, visions, and sweat equity—into something quantifiable. The resulting narrative isn't fiction but a forecast, a glimpse into the future written in the language of probability, trends, and regression lines. It's a scientific approach to the art of potential, and it's transforming how we think about the alchemy of innovation.

The Role of Correlation in Enhancing Matchmaking

Correlation analysis complements our regression models by identifying the strength and direction of relationships between different startup metrics. For instance, we examine how closely related a founder's previous startup success is to the current startup's potential or how market size correlates with growth speed. These correlations help refine our ML models by highlighting which factors are most predictive of success, allowing us to tailor our matchmaking algorithm to prioritize these key indicators.

Correlation analysis is the yin to the yang of regression; where regression predicts, correlation explains. In the intricate dance of startup metrics, correlation leads us through the steps, showing us how each move influences the other. It’s a forensic tool, revealing the fingerprints that factors like a founder's track record or market dynamics leave on a startup's growth trajectory.

Consider the founder's previous triumphs. Are they a harbinger of future feats, or simply fond memories? Correlation analysis measures the strength of their echo in the present venture. Or take market size—a colossus that every startup must wrestle with. How tightly is its vastness intertwined with a startup’s velocity? Through correlation, we measure not just presence but impact.

These correlations serve as the compass points for our machine learning models, guiding them towards the factors that matter most. The beauty lies in the nuance; not all correlations are created equal, and not all are straightforward. Like a detective piecing together clues, our algorithm assesses which relationships bear fruit and which are red herrings. It's a delicate balance of knowing what to embrace and what to discard.

By honing in on these pivotal correlations, we shape our matchmaking algorithm to be not just a tool but a sage advisor, discerning and wise. It prioritizes indicators that have proven their worth in the empirical cauldron of the market. This isn't just data science; it's a symphony of statistics where every note contributes to the harmony of informed decision-making. With each correlation unearthed, our algorithm becomes more attuned to the secret melodies of success, providing investors and startups alike with a score that leads to triumph.

Leveraging PyTorch for Flexible and Powerful ML Models

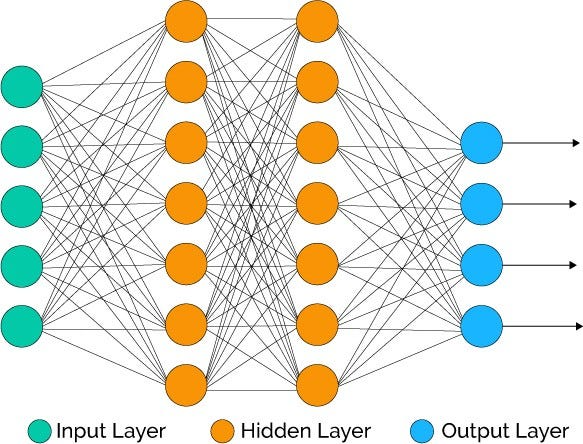

In our quest to deliver the most accurate and useful matchmaking platform, we've chosen PyTorch as our primary tool for developing ML models. PyTorch offers the flexibility and power needed to experiment with various ML architectures, including but not limited to decision trees. Its dynamic computation graphing capabilities allow for more nuanced model adjustments and real-time updates based on new data. This adaptability is crucial for us as we iterate on our QuickMatch feature, ensuring that our platform remains at the cutting edge of technology.

What sets PyTorch apart is its dynamic computation graph, known as Autograd. This is the artist's canvas, allowing the ebb and flow of data to reshape the landscape of our models in real-time. Each dataset is a brushstroke, altering the picture, enhancing the detail, bringing clarity to the once hazy outlines of our predictions. This isn't merely number crunching; it's the breath of life into the silicon heart of our platform.

The flexibility to pivot, to adapt, to learn on the fly—this is what PyTorch grants us. Whether we're cultivating the decision trees' branching wisdom or charting the hidden layers of deep neural networks, PyTorch is the wind in our sails. It is this adaptability that underpins QuickMatch, ensuring that with every match made, every connection initiated, the system grows smarter, sharper, more attuned to the subtleties of the startup-investor courtship.

Moving Beyond Traditional ML Approaches

While decision trees offer a straightforward way to model decisions and their possible consequences, our exploration into ML techniques does not stop there. By leveraging PyTorch, we're able to experiment with a range of models, from linear regression for predicting startup valuations to complex neural networks that can uncover patterns in data that are not immediately obvious. This exploratory approach ensures that we remain flexible and can adapt our models to better predict matchmaking success and startup growth potential.

Our journey through the realms of machine learning is rich and varied, much like the ecosystems of startups we seek to understand. The decision tree, with its clear-cut branches of choices and outcomes, represents only the beginning of this expedition. But as we delve deeper, guided by the torchlight of PyTorch, the terrain expands into more intricate landscapes.

Linear regression models, akin to charting a course across a vast sea by the stars, allow us to predict the valuations of startups with a steady hand on the tiller. Yet, we do not confine ourselves to these celestial navigations alone. The neural networks, complex as the neural pathways of the human brain, offer us the chance to dive into the fathomless depths of data, to find pearls of hidden wisdom within.

The beauty of PyTorch is in its ability to empower these explorations, providing the tools to map the contours of innovation and entrepreneurship. It allows our models to be as dynamic as the startups they seek to serve — learning, evolving, constantly adapting to the ever-shifting patterns of success and the multifaceted nature of growth.

With this toolkit, we forge ahead, knowing that the key to matchmaking prowess lies not just in the paths well-trodden but in the ability to blaze new trails. Our platform is a living entity, enriched with every computation, growing wiser with every match it makes. It's an odyssey that transcends the ordinary, driven by the promise of discovery and the power of machine learning.

Conclusion

The integration of regression analysis, correlation studies, and the utilization of PyTorch within FundRight's QuickMatch feature represents a significant leap forward in startup-investor matchmaking. By moving beyond traditional ML models and continuously refining our approach with cutting-edge techniques, we ensure that our platform provides the most accurate, insightful, and valuable connections possible. For startups and investors alike, FundRight offers not just a path to funding but a roadmap to success, backed by the power of data science.

Join the Exclusive Alpha Test

As part of our commitment to excellence and innovation, we are excited to announce that we are now recruiting participants for an exclusive alpha test of the FundRight app. This is a unique opportunity for early adopters to be at the forefront of our technological advancements and to play a pivotal role in shaping the future of startup investing.

Early Adopters Benefits:

First Access: Participants will receive a completely free lifetime account, ensuring they benefit from our platform's capabilities from the outset.

Free Usage: In appreciation of your feedback and support, you will receive special rewards and bonuses with each new feature release. Your early insights are invaluable to us, and we want to thank you for contributing to our growth.

Direct Influence: Your feedback and suggestions will be instrumental in the development process, allowing you to directly influence the evolution of FundRight. This is a chance to ensure that the platform meets your specific needs and expectations, making it a truly user-driven initiative.

This alpha test is not just about early access; it's an invitation to be part of a community that's shaping the future of startup investments. Your involvement will directly impact how founders and investors connect, collaborate, and succeed in the dynamic European startup ecosystem.

As we move closer to launching our MVP, your participation in the alpha test will be crucial in ensuring that FundRight not only meets but exceeds the expectations of our users. Join us in this exciting phase of our journey, and let's redefine the future of startup investing together.